Thank you! for the details

We will get back to you soon

Health Insurance for NRIs

What is Health Insurance for NRIs

Health Insurance for NRIs is a type of insurance policy that is specifically designed to provide health coverage to Non-Resident Indians (NRIs) who are living and working abroad. This policy also provides health coverage to NRIs and their family members who may require medical treatment in India during their visit. The policy offers a wide range of benefits and can be customized to suit the specific healthcare needs of NRIs.

Inpatient hospitalization

This covers expenses for staying in the hospital, such as room charges, nursing care, and medicine.

Read More...

Outpatient services

This covers services that do not require a hospital stay, such as doctor visits, lab tests, and X-rays.

Read More...

Prescription drugs

This covers the cost of prescription medications prescribed by a doctor.

Read More...

Diagnostic tests and screenings

This covers medical tests such as blood tests, MRI, and CT scans.

Read More...

Emergency care

This covers expenses for emergency medical treatment such as ambulance services, emergency room visits, and urgent care visits.

Read More...

Organ Donor Expenses

In case of organ replacement, a few policies take care of organ donor expenses cover.

Read More...

Add-On covers in Health Insurance for NRIs

Maternity and new-born expenses

Alternative treatment cover

Outpatient treatment expenses

Dental treatment expenses

Health check-ups and preventive care

What Is Not Covered in Health Insurance for NRIs

Pre-existing diseases

Most policies have a waiting period during which pre-existing medical conditions are not covered. This varies depending on the insurance company and policy.

Cosmetic treatments

Cosmetic procedures such as plastic surgery, hair transplant, and dental procedures are usually not covered unless they are medically necessary.

Alternative treatments

Treatments such as Ayurveda, Unani, and Homeopathy are not covered unless specified in the policy.

Non-medical expenses

Expenses that are not directly related to medical treatment, such as transportation costs, food, and accommodation, are usually not covered.

Self-inflicted injuries

Injuries that are self-inflicted, such as suicide attempts or injuries resulting from drug or alcohol abuse, are usually not covered.

Why do you need a Health Insurance for NRIs

Provides peace of mind for NRIs and their families

Protects against unexpected medical expenses during visits to India

Ensures access to quality healthcare in India

Offers financial protection against unforeseen medical emergencies

Key Highlights of a Health Insurance for NRIs policy

Coverage for inpatient, outpatient, and day-care procedures

Cashless hospitalization facilities at network hospitals

Coverage for pre-existing illnesses after a waiting period

Customizable policy options to suit specific healthcare needs

Easy claim settlement process

Tax exemption benefits under Section 80D

How To Buy Online Policy from PolicyLeader

1. Visit the PolicyLeader website

Go to the PolicyLeader website (www.policyleader.co.in) and select "Family Floater Insurance" from the list of insurance products.

2. Provide personal details

Fill in your personal details such as name, age, and contact information. You may also be required to provide details about your medical history.

3. Choose a policy

PolicyLeader offers a range of family floater insurance policies from various insurance companies. Review the policy details, coverage, and premium amounts to choose a policy that best meets your needs.

4. Compare policies

Use the comparison tool to compare policies from different insurance companies based on factors such as premium, coverage, and exclusions.

5. Customize your policy

You can customize your policy by adding or removing riders (add-on covers) to suit your specific needs.

6. Pay the premium

Once you have chosen a policy, pay the premium online using a debit card, credit card, or net banking.

7. Receive the policy documents

After the payment is confirmed, the policy documents will be emailed to you. The policy documents will contain all the details of your policy, including the coverage, exclusions, and terms and conditions.

How to file a Health Insurance for NRIs Claim

1. Notify the insurance company

As soon as you are aware of the need to file a claim, notify the insurance company by calling their customer service or through their website. Provide details such as policy number, name of the insured person, date of hospitalization, and reason for hospitalization.

2. Submit the claim form

Fill in the necessary details and submit it along with the required documents to the insurance company.

3. Provide necessary documents

The insurance company may require documents such as hospital bills, medical reports, discharge summary, prescription receipts, and diagnostic reports to process the claim. Ensure that you have all the necessary documents and submit them along with the claim form.

4. Wait for claim approval

The insurance company will review the claim and verify the documents submitted. If the claim is approved, the insurance company will reimburse the medical expenses as per the terms and conditions of the policy.

5. Cashless claims

If the insured person has opted for cashless hospitalization, the insurance company settles the bills directly with the hospital. However, ensure that the hospital is part of the insurance company's network and follow the necessary procedures for cashless claims.

Documents Required for Health Insurance for NRIs

- Identity proof:PAN card, Aadhaar card, passport, voter ID, driving license, etc. (Passports and PR proof in case of NRIs)

- Age proof:Birth certificate, school leaving certificate, passport, Aadhaar card, etc.

- Address proof:Aadhaar card, passport, driving license, utility bills, etc.

- Medical reports:Reports related to pre-existing medical conditions, if any.

- Income proof:Salary slips, ITR statements, bank statements, etc.

- Policy application form:Filled and signed policy application form.

- Passport-sized photographs:Recent passport-sized photographs of the policyholder.

- Cancelled cheque:For policy premium payment through ECS.

- Other documents:Any other documents as requested by the insurance company.

Why should you choose PolicyLeader for buying Health Insurance for NRIs

Instant claim support

PolicyLeader offers instant claim support to ensure that the policyholders can receive timely assistance in case of any medical emergencies. They have a dedicated customer support team that is available round-the-clock to assist with claim-related queries and guide the policyholders through the claim settlement process.

Read More...

Schedule a home visit with our advisors

PolicyLeader provides the convenience of scheduling a home visit with their advisors to discuss the policy options, understand the individual's needs, and help them choose the best policy that suits their requirements. This service is particularly beneficial for those who are not comfortable with online transactions or prefer face-to-face interactions.

Read More...

Customised 1:1 planning

PolicyLeader offers customized 1:1 planning to ensure that the policyholders get the best possible coverage as per their specific requirements. Their experienced advisors analyse the policyholder's needs, assess their risk profile, and suggest the most appropriate policy options that offer comprehensive coverage at affordable premiums.

Read More...

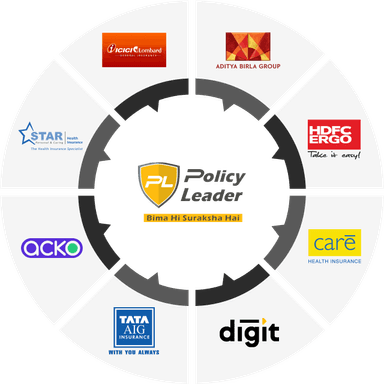

Multiple Insurers Under One Roof and Insurance Brokers in Gujarat and around the country

PolicyLeader has tied up with multiple insurers and offers a wide range of policy options under one roof. This ensures that the policyholders can compare and choose from the best policies from leading insurers. Additionally, they have a strong presence and experienced insurance brokers in Gujarat and around the country, providing personalized and professional service to the policyholders.

Read More...